온라인 정기예금의 장점

-

고정 이자율

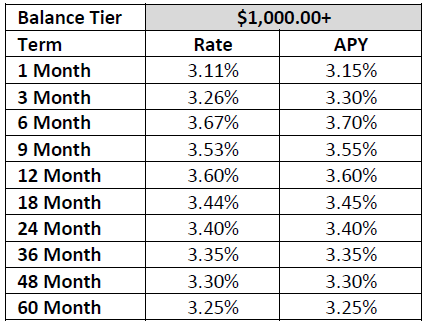

뱅크오브호프 정기예금 계좌는 3.70% APY*까지의 프로모션 혜택이 있는 이자율을 적용해드리고 있습니다. 보통 일반 세이빙 계좌와 비교해 보시면 훨씬 높은 이자율 입니다.

-

예측가능한 수익

시장 및 경제 상황과 상관없이, 온라인 정기예금 계좌로 확실한 소득을 보장받으세요. 안심하고 믿을 수 있는 수익입니다.

-

FDIC 예금자 보험 적용

온라인 호프 프리퍼드 정기예금 계좌는 법의 허용한도 내에서 FDIC 보험에 의해 보호됩니다.

-

24/7 온라인 & 텔레뱅킹

단 몇분안에 온라인을 통해 정기예금 가입이 이루어지며, 언제 어디서나 본인의 온라인 정기예금 계좌를 확인할 수 있습니다.

뱅크오브호프 호프 프리퍼드 정기예금 이자율 (온라인 계좌 개설시)

| 기간 | 이자율/연수익율 $1,000 - $249,999.99 |

이자율/연수익율 $250,000.00+ |

|---|---|---|

| 1 개월 | 3.11% / 3.15% | 3.11% / 3.15% |

| 3 개월 | 3.26% / 3.30% | 3.26% / 3.30% |

| 6 개월 | 3.67% / 3.70% | 3.67% / 3.70% |

| 9 개월 | 3.53% / 3.55% | 3.53% / 3.55% |

| 12 개월 | 3.60% / 3.60% | 3.60% / 3.60% |

| 18 개월 | 3.44% / 3.45% | 3.44% / 3.45% |

| 24 개월 | 3.40% / 3.40% | 3.40% / 3.40% |

| 36 개월 | 3.35% / 3.35% | 3.35% / 3.35% |

| 48 개월 | 3.30% / 3.30% | 3.30% / 3.30% |

| 60 개월 | 3.25% / 3.25% | 3.25% / 3.25% |

보다 다양한 정기예금 기간을 원하시면, 다른 뱅크오브호프 제공 정기예금에 대해 알아보세요.

왜 뱅크오브호프인가요?

- 10년 연속 'Best Banks in America (미국 내 최고 은행)' 명단 등재

- 미국 내 가장 큰 Top 100 금융 기관

- 미국 내 가장 큰 Top 15 SBA 대출 기관 (대출액 기준)

- 캘리포니아 엘에이에서부터 뉴욕 맨해튼까지, 미 전역에 걸친 full-service 지점 운영을 통한 전국적 입지

*APY(Annual Percentage Yield)는 2/6/2026 기준입니다. APY는 계좌의 약정 기간과 디파짓 금액에 따라 달라집니다. 해당 계좌의 기간 동안 이자율은 변경되지 않습니다. 수수료로 인해 계좌의 수익이 감소할 수 있습니다. 만기 이전에 조기 인출할 경우 패널티가 부과될 수 있습니다.

온라인 신청서는 신청을 시작한 날짜로부터 30일 이내에 완전히 작성되어야 합니다. 해당 기간 내에 모든 필수 정보를 제출하지 않을 경우, 별도의 통지 없이 신청이 자동으로 취소될 수 있습니다. 계좌가 개설된 후에는 계좌 개설일로부터 10일(달력일 기준) 이내에 입금이 이루어져야 합니다. 이러한 요건은 모든 온라인 상품에 적용됩니다.

수수료 및 제공 기능을 포함한 계좌 약관은 법에서 요구하는 경우를 제외하고 사전 통지 없이 변경될 수 있습니다. 기타 수수료 및 요금이 적용될 수 있습니다. 예금은 법에 따라 허용되는 최대 한도까지 연방예금보험공사(FDIC)에 의해 보호됩니다. Bank of Hope, Allpoint®, 및 MoneyPass® 네트워크를 통한 ATM 이용은 무료로 제공됩니다. 그 외의 ATM 네트워크를 통한 거래에는 수수료가 부과될 수 있으며, 해당 수수료는 네트워크 제공업체에 따라 다를 수 있습니다.

*APY(Annual Percentage Yield)는 2/6/2026 기준입니다. APY는 계좌의 약정 기간과 디파짓 금액에 따라 달라집니다. 해당 계좌의 기간 동안 이자율은 변경되지 않습니다. 수수료로 인해 계좌의 수익이 감소할 수 있습니다. 만기 이전에 조기 인출할 경우 패널티가 부과될 수 있습니다.

온라인 신청서는 신청을 시작한 날짜로부터 30일 이내에 완전히 작성되어야 합니다. 해당 기간 내에 모든 필수 정보를 제출하지 않을 경우, 별도의 통지 없이 신청이 자동으로 취소될 수 있습니다. 계좌가 개설된 후에는 계좌 개설일로부터 10일(달력일 기준) 이내에 입금이 이루어져야 합니다. 이러한 요건은 모든 온라인 상품에 적용됩니다.

수수료 및 제공 기능을 포함한 계좌 약관은 법에서 요구하는 경우를 제외하고 사전 통지 없이 변경될 수 있습니다. 기타 수수료 및 요금이 적용될 수 있습니다. 예금은 법에 따라 허용되는 최대 한도까지 연방예금보험공사(FDIC)에 의해 보호됩니다. Bank of Hope, Allpoint®, 및 MoneyPass® 네트워크를 통한 ATM 이용은 무료로 제공됩니다. 그 외의 ATM 네트워크를 통한 거래에는 수수료가 부과될 수 있으며, 해당 수수료는 네트워크 제공업체에 따라 다를 수 있습니다.

정기예금 및 온라인 뱅킹에 대한 FAQ

정기예금 계좌는 정해진 기간동안 입금된 자금으로 고정된 이자 수익을 받을 수 있는 상품입니다. 정기예금과 일반적인 세이빙 계좌의 가장 큰 차이점은 정기예금 계좌에 입금된 자금은, 약속된 날짜 이전에 인출할 경우 위약금이 발생한다는 것입니다. 반면 이러한 이유로, 대부분의 정기 예금 상품들은 세이빙 계좌 상품들보다 더 높은 수익률을 제공합니다.

정기예금이 정해진 기간의 만료일이 되었다면, 온라인 정기예금으로 자동으로 갱신되어, 계속해서 수익이 발생합니다. 만약 갱신을 원하지 않을 경우에는, 자금을 인출하거나 만료일로부터 10일 이내에 갱신된 정기예금을 위한 새로운 약정 기간을 요청할 수 있습니다.

정기예금 계좌에 이체되어 있는 자금을 만료일 이전에 인출할 수 있으나, 대부분의 경우, 은행 기관이 조기 인출에 대한 위약금을 부여합니다.

뱅크오브호프에서는 1개월, 3개월 또는 6개월 약정의 정기예금인 경우, 조기 인출에 대한 위약금은 30일간의 이자액과 동일한 금액입니다. 약정기간이 8개월, 10개월 또는 12개월인 정기예금인 경우에는, 조기 인출 위약금은 60일간의 이자액과 동일한 금액입니다. 약정기간이 18개월 또는 18개월 이상인 경우, 조기 인출 위약금은 90일간의 이자액과 동일한 금액입니다.

가까운 미래에 자금 사용 여부가 불확실 한 경우, 적은 금액에서부터 시작하거나 기간이 더 짧은 약정 기간을 선택하십시오. 혹은, 입출금이 자유로운 체킹 계좌를 고려해볼 것을 추천드립니다.

뱅크오브호프는, 정기예금 상품과 기타 모든 뱅킹 업무를 위해 안전한 온라인 뱅킹이 가능하도록, 가용한 모든 방법을 활용했습니다. 여기를 클릭해 온라인 등록에 대해 알아볼 수 있으며, 동시에 여러 단계의 신분 검사를 통해 계좌가 안전하게 보호되고 있다는 사실에 안심하실 수 있습니다.

정기예금 계좌는 정해진 기간동안 입금된 자금으로 고정된 이자 수익을 받을 수 있는 상품입니다. 정기예금과 일반적인 세이빙 계좌의 가장 큰 차이점은 정기예금 계좌에 입금된 자금은, 약속된 날짜 이전에 인출할 경우 위약금이 발생한다는 것입니다. 반면 이러한 이유로, 대부분의 정기 예금 상품들은 세이빙 계좌 상품들보다 더 높은 수익률을 제공합니다.

정기예금이 정해진 기간의 만료일이 되었다면, 온라인 정기예금으로 자동으로 갱신되어, 계속해서 수익이 발생합니다. 만약 갱신을 원하지 않을 경우에는, 자금을 인출하거나 만료일로부터 10일 이내에 갱신된 정기예금을 위한 새로운 약정 기간을 요청할 수 있습니다.

정기예금 계좌에 이체되어 있는 자금을 만료일 이전에 인출할 수 있으나, 대부분의 경우, 은행 기관이 조기 인출에 대한 위약금을 부여합니다.

뱅크오브호프에서는 1개월, 3개월 또는 6개월 약정의 정기예금인 경우, 조기 인출에 대한 위약금은 30일간의 이자액과 동일한 금액입니다. 약정기간이 8개월, 10개월 또는 12개월인 정기예금인 경우에는, 조기 인출 위약금은 60일간의 이자액과 동일한 금액입니다. 약정기간이 18개월 또는 18개월 이상인 경우, 조기 인출 위약금은 90일간의 이자액과 동일한 금액입니다.

가까운 미래에 자금 사용 여부가 불확실 한 경우, 적은 금액에서부터 시작하거나 기간이 더 짧은 약정 기간을 선택하십시오. 혹은, 입출금이 자유로운 체킹 계좌를 고려해볼 것을 추천드립니다.

뱅크오브호프는, 정기예금 상품과 기타 모든 뱅킹 업무를 위해 안전한 온라인 뱅킹이 가능하도록, 가용한 모든 방법을 활용했습니다. 여기를 클릭해 온라인 등록에 대해 알아볼 수 있으며, 동시에 여러 단계의 신분 검사를 통해 계좌가 안전하게 보호되고 있다는 사실에 안심하실 수 있습니다.