Why ICS® (IntraFi Cash Service) and

CDARS® (Certificate of Deposit Account Registry Service)?

-

FDIC Coverage

Secure your entire deposit with FDIC insurance, backed by the federal government. No depositor has ever lost a penny on FDIC-insured deposits.

-

Save Time

Eliminate tracking collateral and managing multiple banks with consolidated statements

-

Transparent Reporting

View account details online 24/7 with secure, consolidated statements.

-

Earn Interest

Put excess cash to work through demand deposit accounts, money market accounts or CDs.

-

Flexible Liquidity

Access funds with ICS® or choose term options with CDARS® for liquidity.

-

Community Impact

Your funds can support local lending and community growth.

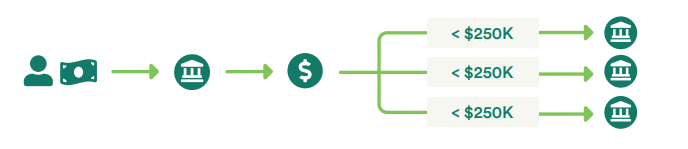

The Power of the Network

Our institution, as a member of IntraFi’s network, offers ICS® and CDARS® services. When you deposit with us through these services, your funds are divided into amounts under the $250,000 FDIC insurance limit and placed in accounts at multiple banks. This way, you get coverage from several institutions while working directly with just one.

How it works

-

Customer makes a large deposit with a local ICS® and CDARS® provider.

-

Customer funds are placed with banks in IntraFi’s network that offer ICS® and CDARS®.

Who can use ICS® and CDARS®?

- Businesses of all types

- Public fund managers

- Nonprofits

- Other large-dollar depositors

Key Product Characteristics

| ICS | CDARS | |

|---|---|---|

| Liquidity | Daily | Term (13-week, 26-week, 1-year) |

| Statements / Documents | Statements available on the first business day of the month |

|

| Per Customer Placement Limit1 |

|

$50,000,000 *weekly limits also apply for each term |

| Depositor Control Panel | Yes | Yes |

| Bank Exclusions | Yes | Yes |

| Interest Compounding | Daily (365 basis days) | Daily (365 basis days) |

| IRS Tax Reporting | If our institution selects this option, Thomson Reuters handles tax-reporting with the IRS on behalf of customers and mails original 1099s to customers | |

*Our institution can use a Resubmission Agreement with a customer to create a nonstandard term by combining successive placements of CDs with standard terms.

[1] Limits subject to change.

Ready to get started?

Contact Us

Call Center:

1-855-325-2226

Mon-Fri: 5:30 am - 6:00 pm (PST)

Sat: 6:00 am - 1:00 pm (PST)

Message Us

Send us an email and one of our

representatives will reach out to

you soon.