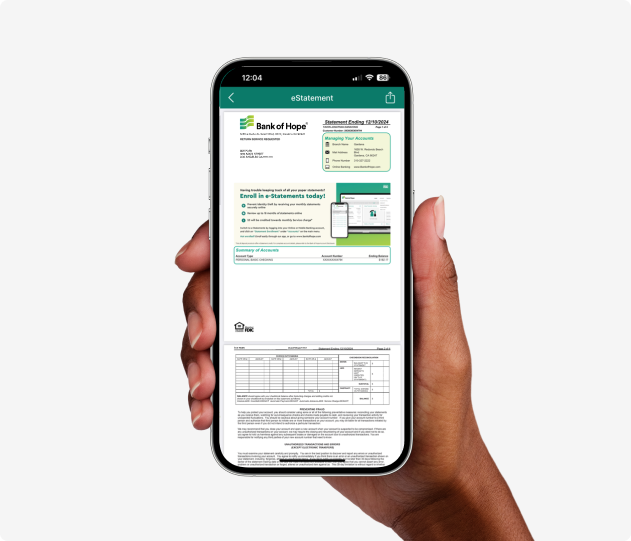

e-Statements Features

Convenient, secure and available anytime

-

Reduced Fees

You may receive a statement credit to waive monthly service charges for eligible accounts.

-

Environmentally Friendly

Reduce mail and paper clutter

with electronic statements. -

Faster Delivery

Monthly statements are available to view faster electronically than by mail.

-

Enhanced Security

Reduce the risk of mail fraud and identity theft.

E-statements are protected with multi-layers of security. -

Organized Records

Each e-Statement is available online for 18 months.

-

Alert Notifications

Receive email notifications to know when your e-Statement is available.

-

Check Downloads

Access images of your written checks and download them.

e-Statements FAQ

You can enroll for e-Statements online or through the Bank of Hope mobile banking app.

Switching back to paper statements is easy and free.

Visit a branch or contact our Customer Call Center at 1-855-325-2226.

The following Personal Banking accounts are eligible for reduced monthly service fees.

Other restrictions may apply. Visit the product page for detailed information.

Personal Preferred Money Market

Need Help?

Digital Banking Help

Visit our learn more page for step by step instructional videos and guide

Contact us

Call Center / Mobile Banking:

1-855-325-2226

Hours

Mon-Fri: 5:30 am - 6:00 pm (PST)

Sat: 6:00 am - 1:00 pm (PST)