Benefits of Opening an Online Certificate of Deposit

-

Fixed Interest Rate

Our Hope Preferred CD accounts grant promo-worthy rates of up to 3.70% APY*. This is significantly higher than the average savings account.

-

Predictable Growth

Rest easy knowing the precise returns of your online CD account, regardless of the markets’ or economy’s performance. It’s reliable money you can count on.

-

FDIC Insured

Bank of Hope's Hope Preferred CD account is covered by the FDIC insurance up to the maximum allowed by law.

-

24/7 Online & Phone Banking

Enroll online for the Hope Preferred Certificate of Deposit in a matter of minutes, and check your acount information whenever you want, regardless of the time.

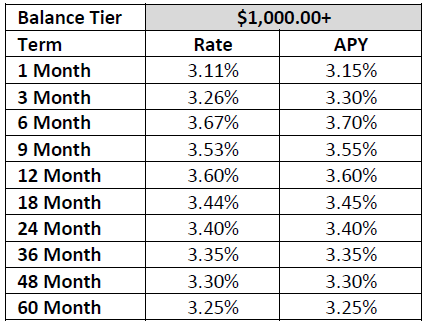

Hope Preferred CD Rates from Bank of Hope (Online Account Opening)

| Term | Rate/APY $1,000 - $249,999.99 |

Rate/APY $250,000.00+ |

|---|---|---|

| 1 month | 3.11% / 3.15% | 3.11% / 3.15% |

| 3 months | 3.26% / 3.30% | 3.26% / 3.30% |

| 6 months | 3.67% / 3.70% | 3.67% / 3.70% |

| 9 months | 3.53% / 3.55% | 3.53% / 3.55% |

| 12 months | 3.60% / 3.60% | 3.60% / 3.60% |

| 18 months | 3.44% / 3.45% | 3.44% / 3.45% |

| 24 months | 3.40% / 3.40% | 3.40% / 3.40% |

| 36 months | 3.35% / 3.35% | 3.35% / 3.35% |

| 48 months | 3.30% / 3.30% | 3.30% / 3.30% |

| 60 months | 3.25% / 3.25% | 3.25% / 3.25% |

For CD accounts with different term options, check out our other offered certificates of deposit accounts.

Why Bank of Hope?

- Listed on Forbes "Best Banks in America" for ten consecutive years

- Top 100 largest financial institution in the U.S.

- Top 15 largest SBA lender in the country by volume

- Leading national presence with full-service branch operations across the country from Los Angeles, California to Manhattan, New York

*The Annual Percentage Yield (APY) is accurate as of 2/6/2026. APYs vary based on term and deposit amount of account. The rate will not be changed for the term of the account. Fees could reduce earnings on the account. A penalty may be imposed for early withdrawal before maturity.

All online applications must be fully completed within thirty (30) days from the date the application is initiated. Failure to provide all required information within this timeframe may result in the application being automatically canceled without further notice. Once an account is opened, it must be funded within ten (10) calendar days from the account opening date. These requirements apply to all online products.

Account terms, including fees and features, are subject to change without prior notice, except as required by law. Other fees and charges may apply. Deposits are insured by the Federal Deposit Insurance Corporation (FDIC) up to the maximum amount allowed by law. ATM access through Bank of Hope, Allpoint®, and MoneyPass® networks is provided at no charge. Fees may apply for transactions conducted through other ATM networks and may vary depending on the network provider.

Start earning today!

*The Annual Percentage Yield (APY) is accurate as of 2/6/2026. APYs vary based on term and deposit amount of account. The rate will not be changed for the term of the account. Fees could reduce earnings on the account. A penalty may be imposed for early withdrawal before maturity.

All online applications must be fully completed within thirty (30) days from the date the application is initiated. Failure to provide all required information within this timeframe may result in the application being automatically canceled without further notice. Once an account is opened, it must be funded within ten (10) calendar days from the account opening date. These requirements apply to all online products.

Account terms, including fees and features, are subject to change without prior notice, except as required by law. Other fees and charges may apply. Deposits are insured by the Federal Deposit Insurance Corporation (FDIC) up to the maximum amount allowed by law. ATM access through Bank of Hope, Allpoint®, and MoneyPass® networks is provided at no charge. Fees may apply for transactions conducted through other ATM networks and may vary depending on the network provider.

FAQ about Certifcate of Deposit (CD) Accounts & Online Banking

A certificate of deposit (CD) account enables your deposited money to earn a fixed interest rate over a predetermined amount of time. There are two key distinctions between a CD and a traditional savings account, the first being that the money cannot be withdrawn from a CD prior to the agreed upon date without a penalty. However, because of this, CD accounts tend to offer greater rates of return than savings accounts.

When your CD reaches maturity at the end of the predetermined term, it will automatically renew as an online CD, continuing to earn you money. Alternatively, you may withdraw your funds or request new terms for the renewed CD if done within ten days of the maturity date.

You will be able to withdraw deposited money from your CD account before the maturity date, but it's commonplace for banking institutions to impose an early withdrawal penalty.

With Bank of Hope's Online Hope Preferred CD, the early withdrawal penalty for a one, three or six month term would be the amount equal to 30 days simple interest. The early withdrawal penalty for eight, ten or twelve month terms will equal the amount of 60 days of simple interest. Terms of eighteen months or longer will have an early withdrawal penalty equal to the amount of 90 days simple interest.

Unsure whether or not you will need access to the initial deposit within the near future? In such a scenario, we suggest starting with a smaller amount, choosing a shorter term option, or considering the flexibility of a checking account as an alternative.

Bank of Hope takes all possible measures to ensure safe online banking for our CD and all other banking activities. While we invite you to click here to learn more about enrolling online, rest assured that your account will be protected by multiple layers of identity detection.

A certificate of deposit (CD) account enables your deposited money to earn a fixed interest rate over a predetermined amount of time. There are two key distinctions between a CD and a traditional savings account, the first being that the money cannot be withdrawn from a CD prior to the agreed upon date without a penalty. However, because of this, CD accounts tend to offer greater rates of return than savings accounts.

When your CD reaches maturity at the end of the predetermined term, it will automatically renew as an online CD, continuing to earn you money. Alternatively, you may withdraw your funds or request new terms for the renewed CD if done within ten days of the maturity date.

You will be able to withdraw deposited money from your CD account before the maturity date, but it's commonplace for banking institutions to impose an early withdrawal penalty.

With Bank of Hope's Online Hope Preferred CD, the early withdrawal penalty for a one, three or six month term would be the amount equal to 30 days simple interest. The early withdrawal penalty for eight, ten or twelve month terms will equal the amount of 60 days of simple interest. Terms of eighteen months or longer will have an early withdrawal penalty equal to the amount of 90 days simple interest.

Unsure whether or not you will need access to the initial deposit within the near future? In such a scenario, we suggest starting with a smaller amount, choosing a shorter term option, or considering the flexibility of a checking account as an alternative.

Bank of Hope takes all possible measures to ensure safe online banking for our CD and all other banking activities. While we invite you to click here to learn more about enrolling online, rest assured that your account will be protected by multiple layers of identity detection.